Caterpillar CEO Joe Creed says the equipment manufacturer is making “steady progress” towards its goal of tripling the number of its autonomous mine haul trucks in operation around the world.

Creed said on a call with analysts after Caterpillar posted its fourth-quarter and 2025 full-year financial results the latest year finished with 827 units working, up from 690 at the end of 2024.

“Adoption is expected to accelerate given our proven solutions, our expansion into quarries and our ability to support mixed fleets,” Creed said.

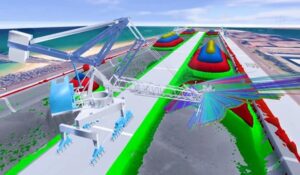

Caterpillar leaders said during a recent company investor day they wanted to triple the 2024 mine auto-truck population by 2030. At the CES 2026 consumer electronics show in Las Vegas this month, Caterpillar said it was working with Nvidia on technology that would make its mining, construction and other machines “ready for AI-assisted and potentially autonomous operations”.

Creed said this week Caterpillar’s Resource Industries business unit, including mining and quarrying sector sales, had positive momentum in the December quarter “with growing backlog supported by healthy orders across a broad range of products”. The company was seeing “positive dynamics” in heavy construction and quarry aggregates in 2026, when it expected the copper and gold sectors to be primary drivers of increased mining market demand and sales.

Resource Industries generated US$3.353 billion of 2025 Q4 revenue, up 13% year-on-year, and $12.45 billion for a year that got off to a slow start.

“Most key commodities remain above investment thresholds and customer product utilisation is high, while the age of the fleet remains elevated,” Creed said.

“With modest increases in commodity prices projected in 2026 we expect rebuild activity to increase slightly compared to last year.”

Resource Industries’ Q4 segment profit was $360 million, down 24% yoy due to “unfavourable manufacturing costs and … price realisation”, with manufacturing costs negatively impacted by US tariffs.

Caterpillar is guiding for a total 2026 incremental tariff cost of circa-$2.6 billion.

Its $67.6 billion 2025 full-year revenues were a record in the company’s centennial year.

Creed said a $51.2 billion order backlog at the end of December was also a record.

Traditional power turbines and surging data centre power generation engine business drove a 23% increase in Caterpillar’s Power & Energy sales to $9.4 billion in Q4 and the company expects the division to deliver its strongest growth in sales in 2026, supported by a robust backlog.

Nvidia CEO Jensen Huang said at the recent CES 2026 event Caterpillar had built industrial machines that shaped the world for a century. “In the age of AI, Nvidia and Caterpillar are partnering across the full spectrum, from autonomous construction fleets to the AI data centres powering the next industrial revolution,” he said.

US investment bank said in January New York Stock Exchange-listed Caterpillar’s share price rose 60% in 2025 versus Nvidia’s 39% gain.

Caterpillar’s shares are up a further 10% early in 2026, capitalising the company at about $307 billion.

Nvidia, valued by the market at circa-$4.64 trillion, has gained about 1%.