A mega-merger, some big royalty and streaming company deals, gold company and platinum carve-outs, Zijin Gold’s Hong Kong IPO and a US$1.4 billion Western government mine underwriting headlined the circa-$81 billion of mining and metals M&A and financing transactions announced in the September quarter.

Of the 135 significant deals publicly reported in the period, there were 81 equity raises of US$10 million or more, 30 M&A transactions (including 16 mergers and 14 asset deals), 17 new debt financings and seven royalty and/or stream deals.

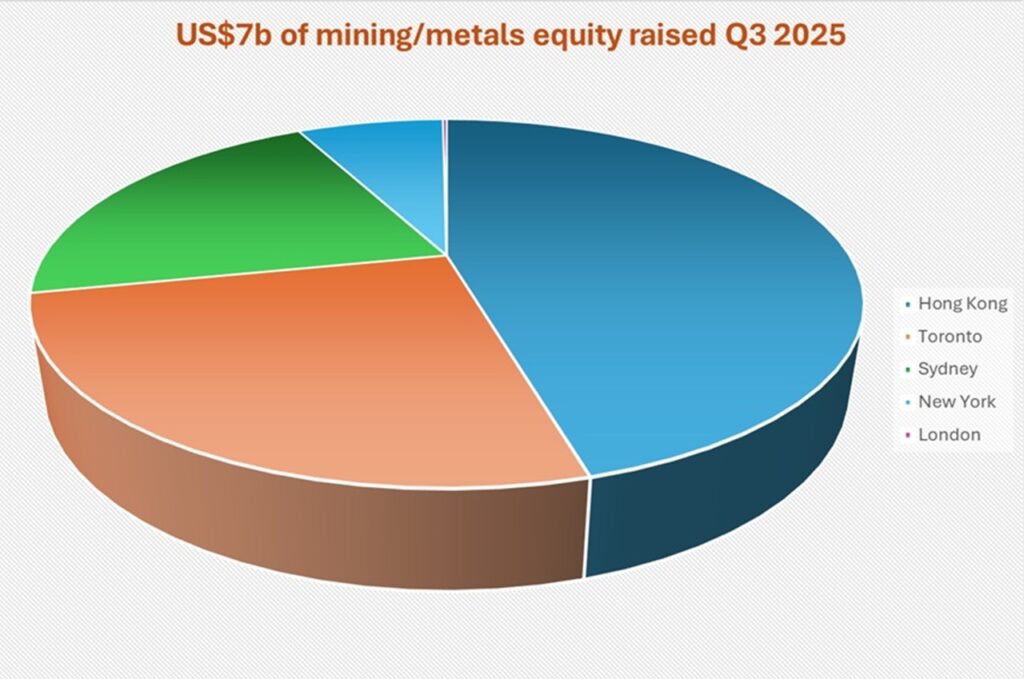

About $7 billion of equity was raised through five main channels.

The $3.2 billion Zijin Gold International IPO in September made Hong Kong the leading global exchange for mining and metals equity financing for the third quarter of 2025, ahead of Toronto ($1.82 billion), Sydney ($1.46 billion), New York ($510 million) and London ($14 million).