Decarbonisation roadblocks may be emerging but there is no drop-off in the forward momentum of mine electrification studies among the vast majority of miners, according to leading consultants.

Skarn Associates executive director Sophie Chung says mining’s majors set the tone for the industry with grandiose operational greenhouse gas (GHG) emission targets that used 2020 baseline GHG levels. She indicated on a Skarn mine fleet electrification webcast that while some companies that had been keen on “keeping up with the next-door neighbour” several years ago had become more circumspect about their progress, “the pressure remains so … that in some respect you have to address this question one way or another”.

“Even if you’re smaller, even if your assets are smaller and they don’t have as long a mine life, there’s still an expectation that you should have a target of some description,” Chung said.

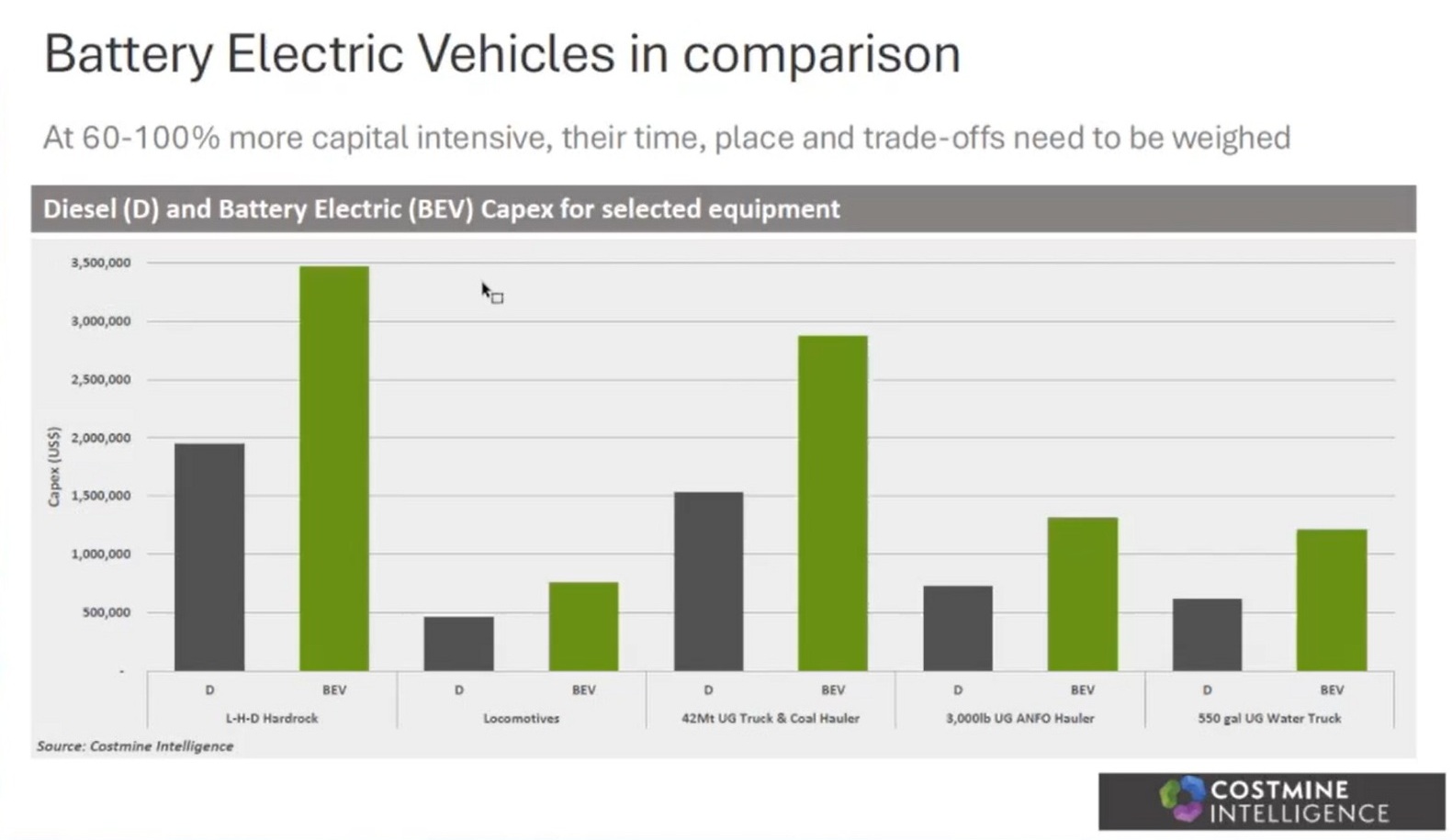

Costmine Intelligence managing director Mike Sinden said on the webinar the “citizenry of the industry” was mostly small-to-medium-size companies rather than majors. With costs – capital and operating – the “bottom line for them and their investors” and battery electric vehicles remaining demonstrably more capital intensive, he questioned whether economics could favour electric vehicles at most new mines any time soon.

“Do they have the luxury of thinking about decarbonisation?” Sinden asked.

Many project preliminary economic assessments (PEAs) and other studies being publicly lodged around the world point to slow uptake of BEVs at mines outside of China.

However, Whittle Consulting Australasia regional manager Philip Bangerter said the level of interest in trade-off studies had not subsided and “junior mining companies with a project are exercised by this in the main”.

Whittle has been a prolific international consultant in the mine optimisation study area for more than two decades, working mainly with non-majors.

“It’s pretty rare amongst our clientele that they wouldn’t try to address some sort of carbon modelling at least and try to understand how their carbon footprint is affected by their decisions, particularly their financial decisions,” Bangerter said.

“Five years ago there was the beginnings of that discussion. Now I would think more than 90% of our clientele would be wanting to understand a carbon question, at least, if not have a thorough understanding of how their decisions affect [emissions].”

The webinar heard more miners – mainly larger companies with long-life operations – were trying to understand the net benefits of electrification and automation in an environment of shifting labour costs and demands from different sectors for specialised skills. Technology was also advancing fast and the regulatory landscape was moving – potentially taking diesel off the table as a fuel option in certain mining scenarios in future.

“The context is hugely important,” said Bangerter.

“So, whether you’re in a high labour or low labour environment, whether there’s automation available or not, [or] whether you have a risk appetite for certain things. Are you a project or are you an operation, is another thing. So, retrofitting infrastructure into an existing mine, the shape of the pit; whether you’ve got a static wall on your pit where you can put in pantographs. All of these things are contextual questions.

“It’s not just costs; there are presumed benefits.”

Bangerter said examination of the benefits needed to go beyond capital and operating expenditure first order cost and trade-off analyses into second and third order business and strategic drivers.

“The first order is really around those capital costs and operating costs and calculating the net present value and present cost. The second order is concerned with the orebody [and] the overall effects of cost changes [in terms of] how the orebody changes. Does it make the orebody bigger? Does it lower cut-off grades? Does it make them higher? And so on. The third order drivers can affect carbon or water or any of the sustainability criteria you might be considering. If you have a third order objective, such as lowering your carbon footprint, what effect does that have on the first order [but then also] the second order factors.

“It’s not sufficient, in our view, to merely understand the trade-off between the capex and the opex nor indeed the increased costs of fleet in the current situation. If you have a material change in costs it has an effect on the orebody. In other words, the cut-offs [grades] will change. The truckload of rocks that you’ve got in the truck: do you turn left to the waste dump or right to the plant? What effect does that have? Do you indeed expand your pit? Do you have the ability to shorten or extend your life-of-mine because of the effect these costs have?

“There’s debate and different ideas around how fast [electric] trucks can go and up what slopes they can go on and those numbers are very important in optimisation because it speaks to slope angles on your pits which can have a lot of effect on your overburden. So that’s a second order effect that is really important.

“Let’s understand the costs really, really well. They’re critical. But … you don’t do it [optimisation] justice if you consider only the first order effects of capex and opex trade-offs and not [weigh] the second order effects.

“There are hidden gems in there.”